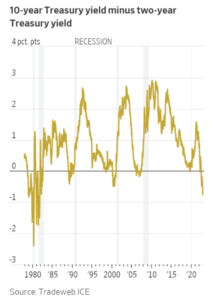

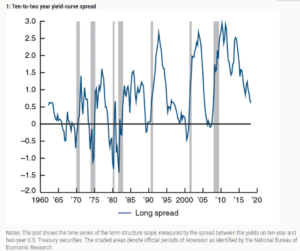

The yield curve – the spread between the interest rate on a 10-year Treasury note and a two-year Treasury has turned decisively negative. This means the rate of interest on short-term bonds is higher than on long-term bonds. Many economists have noted that this is a strong predictor of a coming recession and is an expression of severe investor risk aversion. The yield curve now stands at -0.8% and that is the most negative since 1982.

Most recessions are preceded by inverted yield curves, as shown below.

An analysis by economists at the University of Chicago notes that “the yield-curve slope becomes negative before each economic recession since the 1970s.”

But we aren’t buying the idea that a recession is baked into the cake for 2023. There’s a very benign explanation for why we have a negative/inverted yield curve. Investors believe that inflation is going to continue to gradually come down, and stay down, for the next decade. If they didn’t believe this, they wouldn’t be buying long-term bonds at such a low-interest rate yield.

In other words, if you thought that the average inflation was going to be above 5% for the next decade, you would be losing money (adjusted for inflation) by buying a 10-year bond yielding the current interest rate of 3.75%. But investors ARE buying long-term bonds at these low rates which means inflationary expectations are falling. This is reflected in the 10-year break-even interest rate (TIPS spread) which stands at 2.6% today and has been drifting downward since July.

Or let us state the point differently. Would you feel better about the prospects for the U.S. economy if the long-term interest rate were, say, 10%? That would certainly end the reign of the inverted yield curve, but it would also mean a 12% or more interest rate on a mortgage or a business loan.

Our view is that the best way to fight off a recession and inflation is for Republicans in the House to call for massive ($1 trillion or more) cuts in government debt spending and by expanding the supply side of the economy by opening up the spigots on American energy production.