The Joint Committee on Taxation just released the most absurd revenue estimate in its entire inglorious history. It now projects that any attempt to eliminate the death tax would cost more than $600 billion over 10 years.

This could hardly be further from reality. First, the expected revenue loss is nearly four times what the tax has raised over the past 10 years. How can repealing a tax lose more revenue than the tax raises?

Second, many studies, including our own, find that the impact of the death tax is to reduce capital formation and business investment. That slows the economy and reduces expected federal revenues. The JTC score estimates ZERO economic impact and ZERO increased income tax revenues from eliminating the death tax.

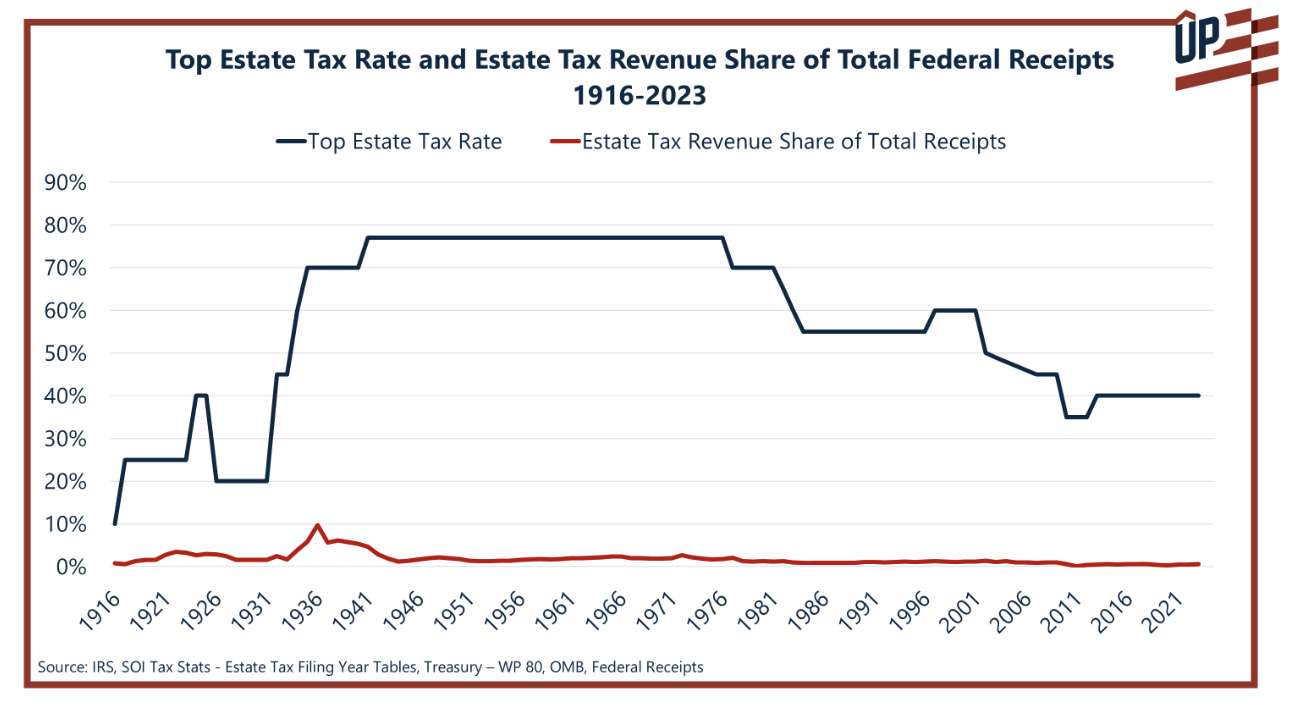

Over the past 100 years the death tax rate has been as high as 80% and as low as 20%, but the revenues have always come in at close to a measly one percent of total federal tax revenues. All this economic damage for a tax that is fiscally irrelevant.

This chart shows the historical top estate tax rate and the percentage of federal revenue raised by the tax:

Senator John Thune was first elected on a promise to repeal the death tax back in 2004. He’ll have to fix the Joint Tax scoring process if he ever wants to deliver on that promise to stop making dying a taxable event.