The big debate in Britain and here in America is whether Prime Minister Liz Truss’s tax cut will expand the debt and crash the economy. So far investors think so – and the British Sterling has gotten hammered since the tax cut’s announcement. It hasn’t helped that the Bank of England has launched a public campaign to sabotage the Truss agenda.

But they should look at the historical evidence more closely.

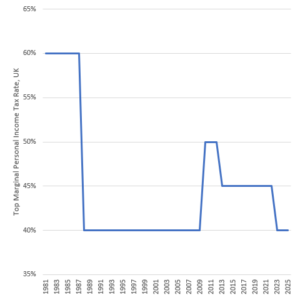

Arthur Laffer reminds us that back in 2010, then-UK Labour Prime Minister Gordon Brown increased the highest tax rate on income from 40% to 50%, the first increase in 30 years. Brown said this would raise £2.5 billion in additional tax revenue.

But the revenues never materialized. In 2012, the British Revenue and Customs office issued a report called “The Exchequer effect of the 50 percent additional rate of income tax.” Here are some of the memorable findings of that report:

-

- “The conclusion that can be drawn from the data is…that the underlying yield from the additional rate is much lower than originally forecast (yielding around £1 billion or less), and it is quite possible that it could be negative.”

- Evidence from the U.S. suggests that the behavioral responses could be even higher… The adverse effect of high rates on personal taxation on both inward and outward migration to the UK and tax revenues can be significant.

- The total income of the affected group in 2009-10 and 2010-11 combined was £203 billion. This was 5 percent below the combined total in the years prior to the tax cut.

- High tax rates in the U.K. Make its tax system less competitive and make it a less attractive place to start, finance, and grow a business.

Truss is basically reversing the disastrous effect of the tax rate increase from a decade before. That can only be highly positive for the British economy. Why the bond vigilantes don’t get this basic truism is still a mystery to us.