Fed chairman Jerome Powell has been adamant of late that the bank’s job isn’t to combat climate change. He recently declared: “Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals.”

But not so fast. Why is the Fed planning to conduct a “pilot climate scenario analysis exercise” involving the six largest US banks: Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo?

We are told that the climate cops want major banks to adopt a plan to handle “climate change-related shocks.”

This would include how banks account for the financial risks associated will hurricanes, droughts, and floods in case their real estate loans and mortgages are underwater – literally and figuratively. The Fed wants this done by August.

Of course, banks should do risk analysis for all types of physical and financial contingencies. But the notion that because of climate change these risks are RISING is flat-out wrong.

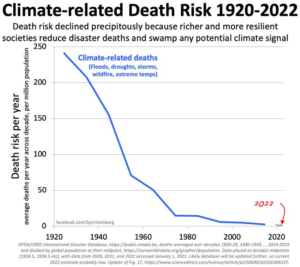

The figure below shows that for the last century deaths from natural disasters have declined dramatically. That’s also true of financial losses. As an advanced economy, we are much better equipped to protect against floods, hurricanes, earthquakes, and other natural disasters – which, by the way, are no more common today than 50 or 100 years ago.

It makes us very nervous when we hear statements like this:

“The Fed has narrow, but important, responsibilities regarding climate-related financial risks — to ensure that banks understand and manage their material risks, including the financial risks from climate change,” according to the Fed’s vice chair for supervision, Michael Barr, in a statement last week.

\

\