We just released our third annual report on proxy shareholder voting by the big banks and money managers. We grade the firms based on which are abiding by their fiduciary duty to get the best return for their clients, and which are voting for ESG initiatives, including climate change, disinvestment in fossil fuels, racial preferences, etc.

Good news: since we started calling out these firms, the share of yes votes for ESG has fallen in half – from 60% to 30%. Next year we hope to get this down to close to zero. Here is the WSJ coverage of the study:

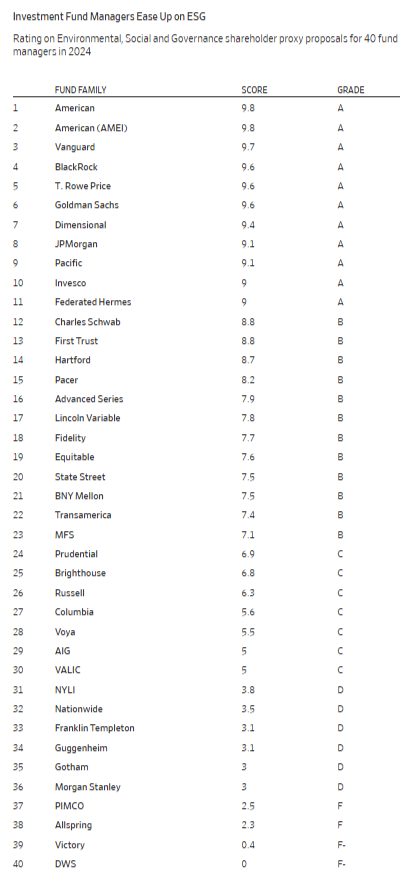

The economic analysts at Unleash Prosperity have been tracking investment votes on corporate proxy proposals for several years, and the trend keeps getting better. In 2022, when it first tracked the votes, most of the largest investment firms danced to the tune of environmental, social and governance proposals. By 2024 most of the firms had taken a notably different approach to ESG.

The nearby table shows the latest Unleash Prosperity rating for 40 of the top funds. The grades measure how well the funds determine their proxy votes based on what really matters for corporate governance, which is the growth and profitability of the firm in the interests of maximum return for shareholders.

The full 2025 edition of our Pension Politics report is available here: