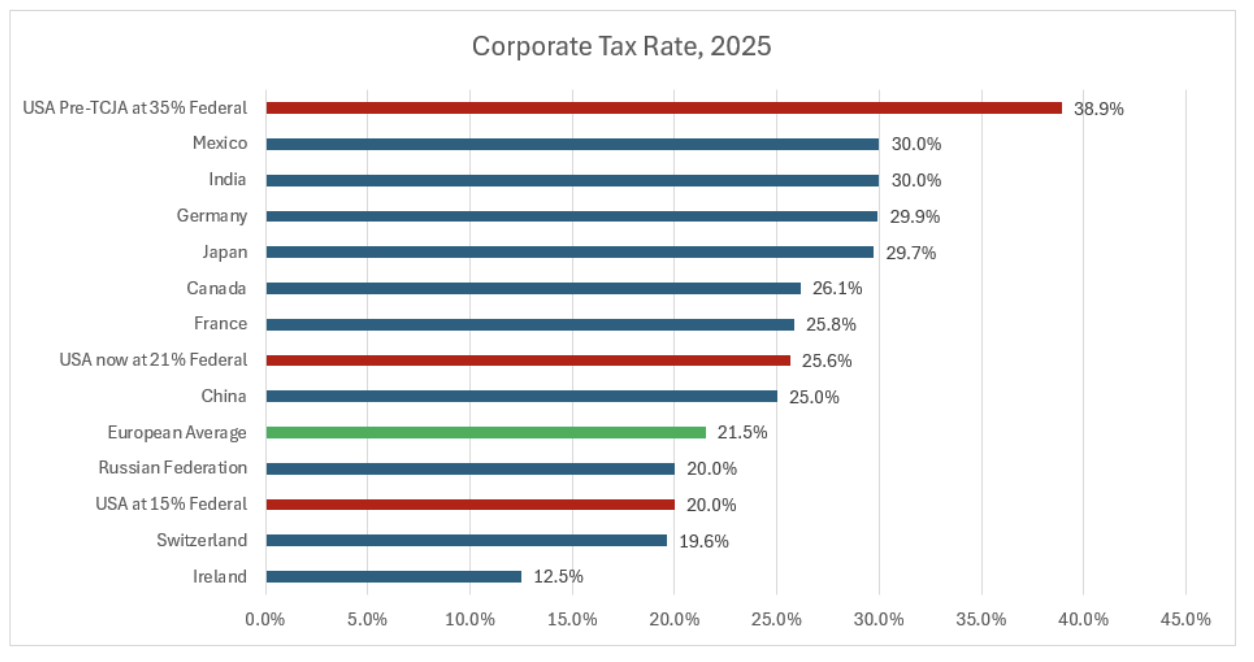

Speaking of putting America first, one of the jewels of the 2017 Tax Cuts and Jobs Act was the corporate rate cut, which brought the U.S. from the world’s highest corporate rate to the middle of the pack. The economy boomed and contrary to the JCT/CBO predictions, revenues soared. More than $1 trillion of investment capital was repatriated back to these shores.

This 21% corporate rate was made permanent. But the job isn’t done yet.

Trump rightly wants a 15% rate, which would give the U.S. an extra competitive boost.

The average rate in Europe is 21.5%, versus a US rate (including state and local taxes) of 25.6%. Trump’s 15% rate would instantly make America the best place in the world to do business, raise productivity and real wages, and raise not lower federal revenues.

If Congress won’t lower the rate to 15% for all American corporations, they should at least enact his “Made-in-America” rate of 15% for companies that predominantly make their products here in the U.S. That would encourage reshoring jobs to every state from Maine to Michigan to Montana.