| Unleash Prosperity Hotline Issue #408 11/10/2021 |

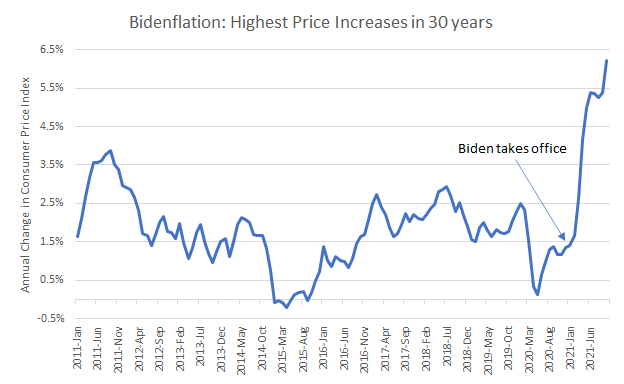

| 1.)Up, Up And Away Labor Department reported this morning that inflation at 6.2% hit a 30-year high in October. This follows on the heels of a Producer Price Index report showing 8%+ price rises for companies. Two takeaways: 1) the Fed is WAY behind the curve in fighting inflation and the “transitory” nonsense is no longer credible. Stop $40 billion a month of bond purchases immediately. Why is the Fed fueling the housing bubble by buying mortgage-backed securities? 2) The Biden administration claim that his $4 trillion debt bomb bill will help solve inflation is laughable and deranged. To believe this is to believe that Al Gore invented the internet. https://nypost.com/2021/11/09/american-consumers-are-paying-a-steep-price-for-bidens-policies/  |

| 2) Now Even The Fed Goes Woke We are no fans of Fed chief Jerome Powell whose ultra-easy monetary policy this year has seen inflation spike to its highest levels since 1980. Producer prices are rising more than 8% year over year. The Fed should have only one core mission – price stability – and it can’t get that right. So now we are hearing that Biden may kick Powell to the curb when his term expires next year and replace him with the most radical leftist on the Fed Board: Fed Governor Lael Brainard. Biden interviewed her for the job last week. Our sources tell us that Democrats want her running America’s monetary policy for two reasons: 1) she wants the Fed to combat climate change through regulation of the banks and 2) she wants the Fed to use its regulatory muscle to address gender equity issues in corporate board rooms. This makes her the choice of the woke crowd and the Elizabeth Warrens of the Democrat party. So now the Fed will have four missions: price stability, full employment, fighting climate change, and gender equity. We despair. If a radical like Brainard is nominated, she should be vigorously opposed. Since monetary stability is a key pillar of economic of prosperity, in the name of “saving the planet” she is likely to put the dollar and America’s economic might in great peril. Our Next Fed chair?  |

Subscribe to receive our full hotline