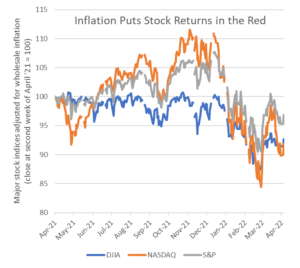

Stocks have been up and down this week, but over the past 12 months, it’s been a bear market for investors. Nominal returns are respectable, but what savvy investors should always be looking at is the stock values adjusted for inflation.

The chart below shows the real returns on the three major indexes in 2022 are negative. The Nasdaq is down 8% after Inflation, the Dow is down 7% and the S&P down 3%. In the short term inflation creates an illusion of prosperity. But the medium and long-term effects of inflation (especially at 8.5%) on equities is negative.

It’s a painful reminder that as our co-founder Steve Forbes points out in his fabulous new book “Inflation,” financial markets, and the economy, do best when the dollar is strong and stable.