You’ve by now surely heard the news this morning that Elizabeth Truss has canceled the key part of her tax cut, which would have chopped the UK’s top tax rate from 45 to 40%. A small income tax cut for the middle class and some business tax relief remain. All of the crazy spending in the plan – such as energy subsidies also remain. The tax rate cut would have increased growth, investment, and production. It would have likely LOWERED inflation. The Reagan and Trump tax cuts reduced inflation. The IMF trashed the tax cut as did the Bank of England and the media as “tax cuts for the rich.”

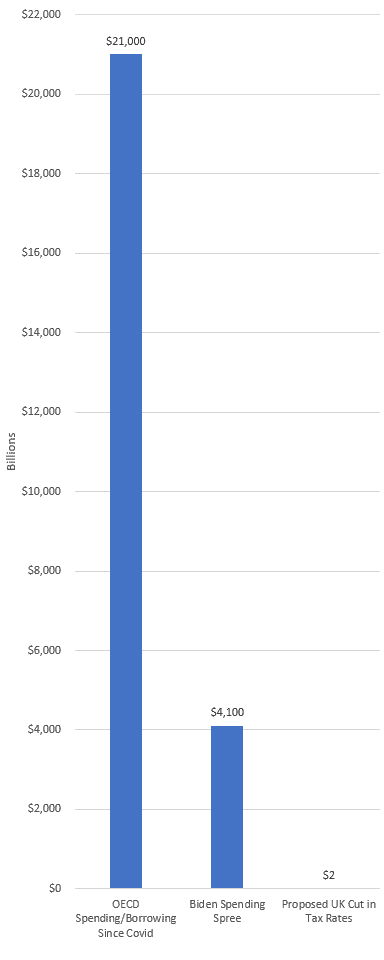

But here is what is Mad Cow Disease crazy about these developments. The tax cut that was scuttled was expected to “cost” about $2 billion. This evidently caused the bond market to go into cardiac arrest and it’s cancellation caused joy in financial markets around the world.

But why?

Contrast this tiny tax cut with the $21 trillion spending spree across the globe since COVID. Or contrast that with the $4 trillion Biden has spent in 20 months.

The bond market is afraid of the mouse, not the elephant. Amazing. Madness. For more on this, we recommend a great column from Holman Jenkins of WSJ this weekend.

Here is a link to Art Laffer’s analysis of the original Truss-Kwarteng plan:

https://www.scribd.com/