Here’s an economic statistic that Joe Biden is sure NOT to talk about in his State of The Union address tonight. The American consumer spending spree continues unabated, but more and more of it is being financed with plastic as credit card balances have surged to nearly $1 trillion.

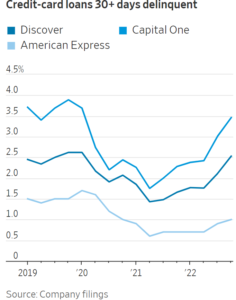

Over the past two years, the delinquency rates have been rising, as the below charts from the Wall Street Journal show. Capital One and American Express report that they are putting billions of dollars into reserves to cover delinquencies and defaults. For consumers, credit card debt is the worst way to borrow, because late fees can reach 20% interest rates.