We’ve argued many times on these pages that Republicans are fools for talking about cutting Social Security benefits. Benefits for retirees who paid into the system for 40 years or more are far too LOW, not too high. Payroll taxes put into an indexed 401k plan would be paying workers three to 10 times higher benefits.

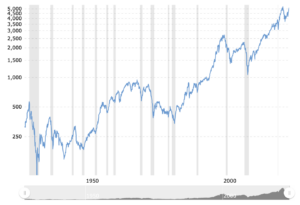

Here’s a simple example. In 1994 the S&P 500 stood at 450. Today it is at 5,000. How tragic is it that Congress didn’t let workers have some of this money invested in stocks, as Steve Forbes has argued for years? Instead of skimpy retirement benefits of $2,000 a month, retirees would be getting on average closer to $5,000 a month. They would also be able to leave to their kids a $1 million-plus inheritance to their kids.

Our friend Andy Puzder argues in The Wall Street Journal that Canada has a government pension program that is financed by half the payroll taxes invested in the stock market. Their plan is financially solvent while ours will be technically bankrupt in a decade or so.

This chart shows that the Canadian system isn’t running on empty, while ours is on the verge of going kaput.