It doesn’t get much dumber than this. The Biden Justice Department is blocking an attempt by Capital One bank to acquire the credit card company Discover. The regulators claim this will give Capital One too much power in the credit card industry.

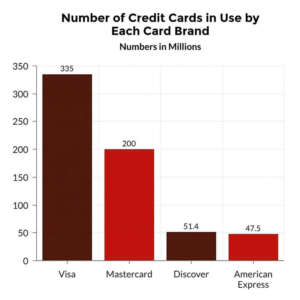

Come again? Today two credit card companies dominate the industry: Visa and Mastercard – with about 80% of the market that now processes more than $5 trillion of retail and online transactions. There is nothing nefarious here: Visa and Mastercard are accepted almost everywhere, and they provide customer convenience, reward points, cash-back incentives, and so on, which shoppers love.

Discover is in a distant third place with about 8% of the market, just ahead of American Express.

Question: how can a bank’s acquisition of a company that controls less than 10% of the market be anti-competitive?

Capital One clearly hopes by marrying up with Discover they can give the two dominant players – Visa and Mastercard – a run for their money. And given Capital One’s vast financial resources, Discover may cut fees and interest rate charges to gain market share. Again: how is that anti-competitive?

Someone needs to tell the Biden regulators: If two major rivals compete, that’s good. If three do, that’s even better for consumers.

Rather than allowing more free-market competition in the industry, the Biden administration wants to impose credit card price controls. When and where have those EVER worked?