This story in the Financial Times signals a major victory in our crusade at CTUP against woke investing:

“Investors have withdrawn a net total of $40 billion from environmental, social, and governance (ESG) equity funds so far this year as poor performance, a series of scandals, and attacks from U.S. Republicans hit enthusiasm for a much-hyped sector that has pulled in trillions of dollars of assets.”

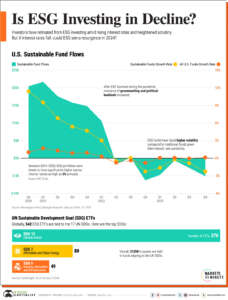

Here are two charts that document this retreat that started in 2022.

Wow, this is a big deal for two reasons. First, it shows that ESG has become a toxic term – like Bud Light – and companies are rightly backing away from a fad that puts political biases ahead of sound financial judgments.

Second, just as we’ve been saying for three years now – and we were heavily criticized for saying it – ESG is a money-loser for investors. Investment dollars aren’t being steered to companies based on their profitability but for some ephemeral commitment to saving the planet or social justice.

The pullback from ESG investing has even reached Europe, the strategy’s traditional stronghold, where ESG equity fund outflows were a net $1.9bn in April.

Pierre-Yves Gauthier, head of strategy and co-founder at AlphaValue, a Paris-based independent research company, tells the FT that “the ESG sector is like the dot.com bubble hype that burst in 2000. “