One of our many objectives when we at Unleash Prosperity helped design the original Trump tax cut in early 2017, was to stop American companies from fleeing the U.S. and moving factories and jobs overseas. Under Obama, dozens of major companies engaged in tax inversions – which happen when companies move out to take advantage of lower tax rates outside the U.S.

America had the highest corporate tax rate in the world at 40% (state and federal rates combine), while the rest of the world was closer to 20%, and some countries were at or below 15%.

By cutting the federal corporate tax rate from 35% to 21%, the incentive to pack up and leave the USA was greatly diminished.

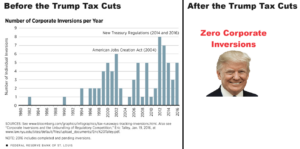

The policy was an astonishing success. The chart below shows that the number of companies fleeing the U.S. fell to zero after the Trump tax cut. According to former House Ways and Means Committee Chairman Kevin Brady, there has not been a single inversion in five years 2018-22.

The companies and the jobs stayed here. They’re likely to stay firmly planted here – unless Biden or Kamala is elected and raises the rate back up to 28%.