The opposition to the Nippon Steel/US Steel deal from across the political spectrum is a dangerous closing of the American economy. Blocking foreign direct investment from an ally like Japan undermines our economic interests and sends the wrong message to global investors.

Our Unleash Prosperity study explains how the $14.9 billion Nippon Steel acquisition to rejuvenate U.S. Steel, will bring technological advancements, productivity gains, and a commitment to maintaining current labor agreements. The study also emphasized the strategic importance of welcoming foreign investment, particularly from a close ally like Japan, in countering global competitors like China.

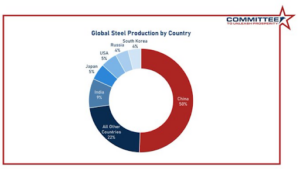

Nobody is smiling bigger than Xi Jinping at the apparent scuttling of the deal while China moves to dominate the global market:

There is even more at risk than the multi-billion-dollar injection of capital and technology into the American steel industry. Blocking a major investment from an investor-owned company headquartered in a major ally would represent a unique departure from the historic openness of US markets. We agree with our friends at the Wall Street Journal editorial page: this is one issue in which Trump and Harris agree, and they’re both dead wrong.

Our study found:

Although U.S. affiliates of foreign multinational enterprises comprise less than 1% of U.S. companies, in 2021 these affiliates in America accounted for 13% of business spending on research and development, 17.3% of investment in plant and equipment, and 23.6% of total goods exports. In short, foreign direct investment fuels a disproportionate share of U.S. economic growth.

And far from exporting American jobs, multinational affiliates employed more than 7.9 million U.S. workers, of which 35% were in manufacturing – far higher than manufacturing’s 9.7% share of all U.S. private-sector jobs today. Total annual compensation at these companies averaged $86,859 per worker, a full 22% above the average for the rest of the private sector.

Ironically, our politicians are scaring off foreign investment in the private sector at the exact same time they are borrowing more money than ever from abroad to finance government spending!

The full study is here: