| Unleash Prosperity Hotline Issue #270 04/23/2021 |

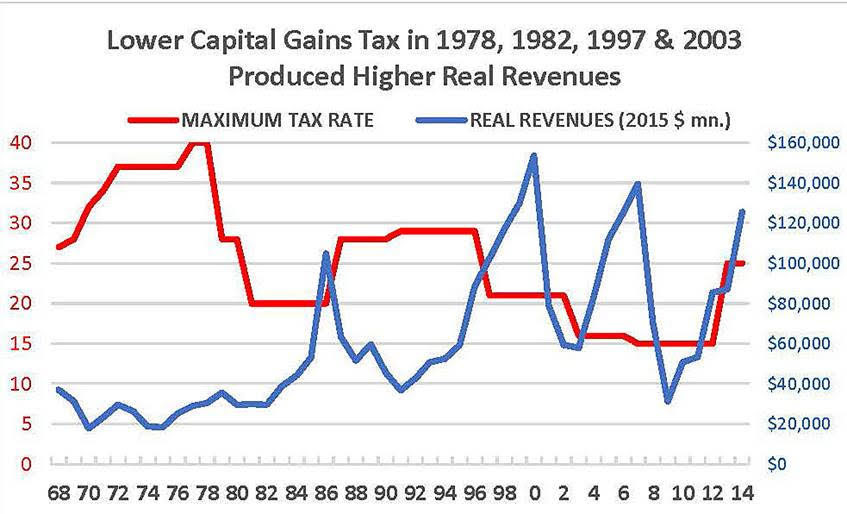

| 1) Biden’s 43% Capital Gains Tax Blooper The stock market had been predicting that Biden would call for a 28% capital gains tax, so when the word came out yesterday that he wants 43%, it triggered a stock sell off. A share of stock is simply worth its after-tax and after-inflation rate of return, so a higher capital gains tax (combined with and a higher corporate tax) translates into lower stock values – by definition.  How confiscatory is the Biden proposal? Consider what it means for taxpayers in the highest tax states — one of which was until recently the country’s financial capital.  The all-out tax assault on capital is not even about funding Biden’s big government spending programs. High capital gains tax rates are more likely to cost the federal government revenue than to raise it because investors will sit on highly appreciated assets until rates come back down — or perhaps until retirement when they have less income. This is called the “lock in” effect of the tax. History shows that capital gains realizations are highly negatively associated with the capital gains tax rate – which means less liquidity in capital markets and less available funds for new start-up businesses.  As this chart shows, historically, lower capital gains tax rates have resulted in higher revenue and in the 1970s when we had Biden-like rates, revenues were very low. So a higher capital gains tax is bad for the economy and bad for the U.S. Treasury. Good call, Joe. |

Subscribe to receive our full hotline