| Unleash Prosperity Hotline Issue #259 04/08/2021 |

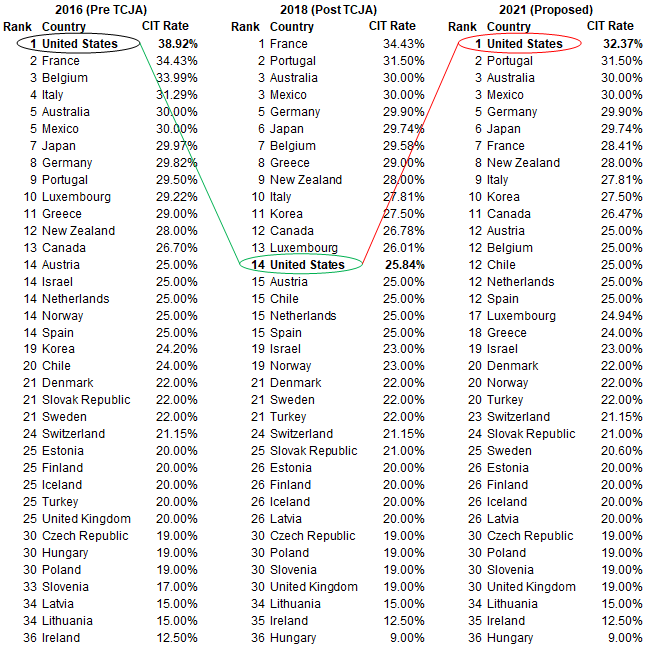

| 1) Biden’s Corporate Tax Hike: Putting America Last Last week Joe Biden explained his $2 trillion tax-hiking scheme by saying: “We’re going to raise the corporate tax. It was 35%, which was just too high. We all agreed five years ago, it should go down to 28%, but they reduced it to 21%. We’re going to raise it back up to 28%. It’s still lower than what that rate was between World War II and 2017. Just doing that one thing will generate one trillion dollars in additional revenue over 15 years.” CTUP co-founder Arthur Laffer’s new study eviscerates the illogic of this strategy: “Biden is correct. A 28% federal corporate income tax rate is historically low. But what he fails to mention is that the corporate tax rates of other advanced economies are also significantly lower than they have been in the past. Increasing the corporate income tax rate to 28% will severely impact the competitiveness of the U.S., stifle growth, and will not produce the intended revenue increases. Biden’s tax plan is accelerating the United States’ ‘race to the bottom.’” The chart below illustrates that on business taxes, the Biden takes America in the global race for capital from worst (Pre-Trump), to first (under Trump) to worst again (Biden). This isn’t just economically foolish, it is unpatriotic.  |

Subscribe to receive our full hotline