The tax bill that Democratic Senate Finance Committee chairman Ron Wyden and House Ways and Means Committee chairman Jason Smith have crafted passed the GOP-controlled House, but is stalled in the Senate.

The bill is far from perfect, but it has three strong virtues:

First, it diverts the policy conversation toward cutting business taxes at a time when President Biden wants to substantially raise them. That’s a valuable shift in the debate in Washington.

Second, the R&D tax credit offsets some of the high costs associated with new drug development, while the expensing provisions — which allow companies to write off expenditures for capital purchases — are critical incentives for business investment.

Third, passing this bill now, makes it much less costly for Trump to make his entire tax cut of 2017 — which CTUP had a heavy hand in — permanent if he is elected in November. If Biden wins, getting these business tax cuts in the bank — even temporarily — is all the more essential.

Some of our friends argue that the child credit payments will discourage work – and they are right.

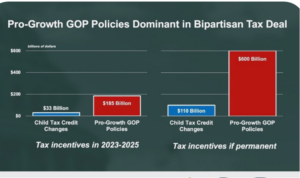

But as the chart below from the Ways and Means Committee shows the benefits outweigh the costs.