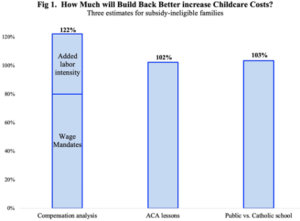

Those are the findings of CTUP senior fellow and University of Chicago Professor Casey Mulligan in a new paper, highlighted in today’s Wall Street Journal. Wait, this bill was supposed to REDUCE child care costs. Casey finds that for the half of families not immediately eligible for the child care subsidies costs will rise by as much as $30,000 a year for several reasons:

Casey explains the cost drivers in today’s WSJ:

The new program would act like a $20,000 to $30,000 annual tax on middle-income families.

First, it would remove much of the incentive to offer lower-cost care. Millions of families would have their child-care expenses capped by statute, which means they’d pay the same at an expensive facility as at a cheaper one.

Second, providers would need extra staff to comprehend and comply with all the new statutes, certifications and agency rules. Just as physicians complain about paperwork eating up time that could be spent with patients, child-care providers will lose time they could be spending with kids.

Third, the bill imposes “living wage” regulations on staff pay.

You can read the full paper here:

https://committeetounleashprosperity.com/wp-content/uploads/2021/11/BBB-Impact-on-Child-Care.pdf