There are a few exceptions – FA Hayek, Milton Friedman, and James Buchanan, for example – but most winners of the Nobel prize in economics have been awarded to big-government Keynesians. And most of the medal winners have an abysmal record of predicting the future. Remember, more than 14 Nobel laureates in economics wrote a joint letter in the New York Times last year assuring us that Biden’s policies would NOT cause inflation.

So when former Fed chairman Ben Bernanke was awarded the prize on Monday for teaching us how the federal government should respond to financial crises, we weren’t too surprised. Giving the prize to Bernanke for his work on how government can deal with financial crises and how he responded to the 2008 mortgage meltdown when he was Fed chairman. As the Wall Street Journal editorial page points out, it was Bernanke who miaintained the near-zero interest rate policies at the Fed that inflated the housing bubble in the first place. Then when the bubble it helped create burst, it partnered with the Bush Treasury Department to implement trillions of dollars of bailouts to the bad actors and government “stimulus.” As a consequence the economy did not fully recover for more than five years – from what could have been a temporary financial readjustment.

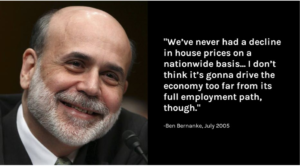

This video of Bernanke from a 2007 hearing before the financial crisis hit, in which he says that there was little danger from the subprime housing sector, exposes how wrong he – and so many of the other brainiacs at the Fed – were.