Time for our CTUP quarterly inflation gauge. Regular readers know that we like to look at five market lead indicators for inflation. Here’s what we found:

* Commodities index. The real-time CRB index of roughly two dozen commodities from coal to copper to corn shows an upward trend in prices. The index is at 320 when it should be at about 300.

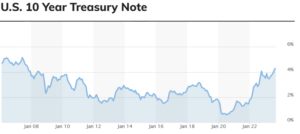

* Ten-Year Treasury Bill Interest Rate

The interest rate on the 10-year Treasury has been nudging up and now stands at 4.3%. When Trump left office it was a little over 1%. The market foresees inflation at roughly 4% right now.

* Gold Price

Gold is still one of the best hedges against inflation. The price of gold remains in the $1,900 to $2,000 range. Not much sign of inflationary expectations here.

* TIPS spread

TIPs is a bond that pays out an interest rate equal to the market’s 10-year expectation for inflation based upon Treasury securities interest rates. It is showing inflation running at about 2.3%.

*M2 Money Supply

This chart shows the giant increase in dollar creation in 2020 and 2021 and the slight pullback in 2023. Since inflation is too many dollars chasing too few goods, this decline in M2 is a check on inflation, but there’s still a lot of cheap money sloshing around out there.

Our bottom line: we aren’t out of the woods on Bidenflation and we see inflation at or above 4% for the foreseeable future. That’s twice the Fed target rate of 2%.

The best policy remedy: cut several trillion off government spending programs—as soon as possible.