| You’ve probably heard the good news that our hero Senator Joe Manchin (D, WV) has saved the day again by shooting down the Biden proposal to tax unrealized capital gains. Since this bad penny keeps rolling around every several months, we thought as a public service we would explain the dishonest statistic Biden uses.

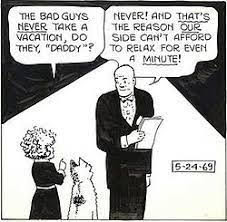

Let’s take on his favorite talking point that secretaries pay higher tax rates than billionaires with capital gains income. How is that possible? The corporate tax rate is 21% and the effective rate companies pay is roughly 17%. (Unless they are wind and solar companies in which case they effectively pay zero tax.) So, Uncle Sam takes 17% off the top and then when shareholders sell their stock, the capital gains tax of 23.8% is applied to the appreciation in value from the time of purchase. So, the real tax rate on stock ownership is: 17% paid at the corporate level + 23.8% x (1 – .17) = 37%. So who and where are these Daddy Warbucks billionaires who own companies paying 8%? |