We liked the business extenders in the bipartisan bill the House passed, especially 100% bonus depreciation for capital investments and the full write-offs for R&D expenses for tech and new drug innovation. Our view is ALL business expenses should be immediately deductible in the year the expense was incurred. Period.

Two sensible fixes in the Senate would vastly improve the bill. First, don’t make ANY tax provisions retroactive. Extend these provisions for the future years – not the past. You can’t change behavior for events that have already happened.

Second, as we’ve noted previously, the child credit eligibility needs to be only for families with a parent who is CURRENTLY working, not for families with a parent working last year. This change will encourage – rather than discourage work.

Senate majority leader Chucky Schumer is telling Senate Republicans: no amendments to the bill. Take it or leave it.

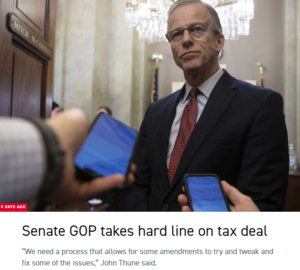

Senate Republican Senate Whip John Thune is saying no deal and he’s right. Mend it, don’t end it.