Venture capital markets are essential for turning small start-up companies into large, profitable firms. They are the seed corn for future economic growth, innovation, and a prosperous U.S. economy.

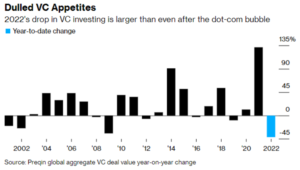

So it’s bad news that, according to Pregin, an asset market data firm, in 2022 venture capital financing suffered its worst drought in at least a quarter century.

Bloomberg reports that this year’s sharp declines in VC funding “surpassed the nadirs of the early 2000s when the DotCom bubble burst and the 34% collapse after the 2008 financial crisis.”

Why is it happening? VCs are the latest victim of Bidenflation of 7% and the related sharp rise in interest rates- which make bonds a relatively more attractive investment and require higher returns on at-risk capital. The tech sector’s financial implosion was also a big factor in the funding retreat. A related problem: higher inflation raises the real tax rate on capital gains, which sucks more of company returns into the coffers of the IRS and less into the bank accounts of investors.