We LOVE to see a booming stock market as we did yesterday, but we suspect there is a lot of irrational exuberance on the inflation front.

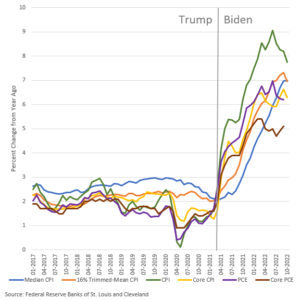

Markets soared yesterday after the inflation report showed a slowing of inflation to the 4 to 5% range for the month of October. We’re not at all convinced that the worst is behind us. We still have nine months in a row of inflation at near or above 8% – which is hardly transitory. Meanwhile, energy costs are still very high – look at diesel and home heating costs. Diesel costs are twice what they were when Trump left office, and nearly every truck in America is fueled by diesel. Higher energy and transportation costs mean higher prices all up and down the supply chain.

More importantly, Biden boasted that much of his multi-trillion dollars of spending in the Inflation Acceleration Act and other bills haven’t even hit the marketplace yet. These dollars of demand will get spread around in the economy in 2023. You’d be a fool to think that saturating the economy with more government outlays is going to REDUCE the inflation rate – but that’s the line from the White House. We’re not buying it and you shouldn’t either. Bidenflation is here to stay until we get real spending CUTS out of Washington.