Sometimes we think everyone in Washington is suffering from severe financial amnesia.

It was only 14 years ago a trillion-dollar housing market propped up by lenient lending standards, and subsidies through Uncle Sam’s giant mortgage insurers Fannie Mae, Freddie Mac, and FHA, crashed the economy. Even with hundreds of billions of government bailouts, the economy suffered its deepest recession since the Great Depression. The politicians told us that Fannie and Freddie were invulnerable, but instead, the taxpayers rushed to funnel in more than $100 billion to rescue them.

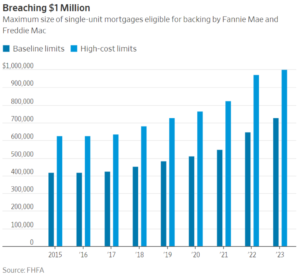

Here we go again. The WSJ reports that Fan and Fred are now being authorized to insure homes of more than $1 million (in high-cost housing markets) for the first time ever. How many first-time home buyers purchase a million-dollar home? How many middle-class Americans can afford a million mortgage?

Trump tried to rein in these massive mortgage insurers and tighten their lending standards. Just the opposite is occurring. Many mortgages now insured by taxpayers carry down payments of less than 5% of the mortgage. These are the mortgages at the greatest risk of default.

We are at great risk of another housing bubble bursting and Washington just further inflated it with more at-risk taxpayer money. This could get ugly.