We find it reprehensible that President Biden and his Treasury Secretary Janet Yellen continue to warn of a “default on the debt” (even though they know it will never happen) to win political advantage in budget talks with Republicans. This reckless, scare tactic rhetoric will discourage investors to buy U.S. securities, which will increase the cost of borrowing and cost taxpayers billions.

To repeat: There will never be a default on the debt even if the debt ceiling is reached because the government will have enough revenue still coming in to easily meet the full faith and credit obligations of the U.S. Government. It would force a temporary shutdown of non-essential government agencies like the Department of Labor, the Department of Education, and foreign aid programs but we’ve handled that before easily.

It turns out investors aren’t buying the nonsense and there is no “Default Scenario” being priced into bond prices, as explained in this fascinating analysis by the financial experts at Fisher Investments:

In our long, long, long history of too frequent, repetitive coverage of debt ceiling fights over the years, we have seen many argue investors would demand a deeper discount to buy these Treasury bills at auction, resulting in a high effective yield and probably very low demand.

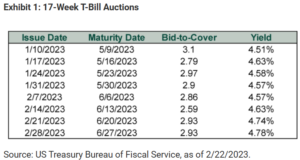

We aren’t seeing that right now. Exhibit 1 shows this year’s auctions of four-month T bills, with maturity dates in May and June—when Yellen estimates the X date will strike. But yields haven’t much budged, especially when you factor Fed short-term rate hikes in.

So what are the markets seeing? One could argue they know this kind of grandstanding over the debt ceiling is commonplace and has always ended with a deal raising the limit. But they may also see that interest payments are routinely below monthly Treasury revenues, giving the Treasury plenty of bandwidth to continue servicing debt without borrowing if it has to. They may know that the Supreme Court has interpreted the 14th Amendment as requiring the Treasury to prioritize interest payments, and past Treasury secretaries, nonpartisan watchdogs and the New York Fed—which actually makes the payments—have confirmed doing so is legal and feasible. Markets probably have figured out that if Congress decided to drag this thing out beyond the X date that the practical outcome would look a lot like a partial government shutdown.

The real default risk comes from a Greece-style crisis that will occur years from now if we fail to address the debt – and we sure wish the president of the United States and the Treasury Secretary would take THAT crisis (as explained in Item 1 above) seriously.