We’ve been warning about this since the “Unaffordable Care Act” was first proposed more than a decade ago. Now we have concrete evidence we were right all along.

Recall that the behemoth insurers like United Health pulled off one of the most cynical lobbying double crosses in American history when Obamacare was being debated. They spent hundreds of millions of dollars lobbying in favor of Obama’s plan under their own trade association’s brand, while spending a similar sum through the US Chamber opposing a government-run “public option.” The result? They hit the taxpayer-funded jackpot.

Paragon Health Institute reports:

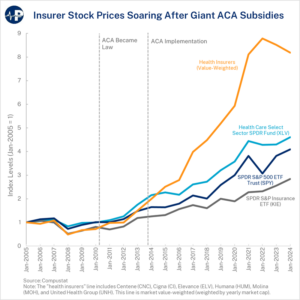

As the Paragon Pic shows, the weighted average of health insurer stock prices are up 1,032 percent from 2010, when the ACA was enacted, and 448 percent from 2013, the year before implementation of the ACA’s key provisions. By comparison, the average respective growth of the most popular S&P 500 exchange-traded fund (ETF) was 251 percent and 139 percent. ETFs are actively-traded funds that own a basket of securities. They often try to track the financial performance of an index, such as the S&P 500 or a specific sector of the economy.

The figure shows the trends over time for the S&P 500 ETF (navy blue), a general health care ETF (light blue), a general insurance ETF (gray), and a market value-weighted group of health insurer stocks compiled by Paragon (orange). Generally, the four industry categories tracked each other closely prior to the ACA taking effect. However, a large divergence appeared once the ACA was implemented, with the health care fund, and particularly the group of health insurer stocks, surging.

The conservatives who are worried about corporate power should set their sights on these guys, who are now functionaries of big government and getting rich off of taxpayers. When Democrats finally pursue their endgame strategy of dealing out the “private” insurance middleman to cut costs, sorry, but we’re not going to lift a finger to defend them.