This article from the Wall Street Journal caught our attention.

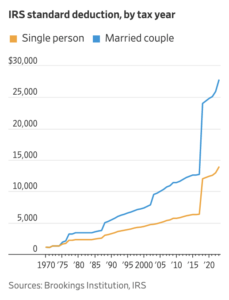

The income cut-off for the highest income tax rate rises from roughly $540k to $578k. The standard deduction is from $12,500 to $13,850 for a single.

The estate tax exclusion rises from about $12 million to $13 million. The WSJnotes this is the largest one-year increase since the tax code was first indexed for inflation in the early 1980s.”

Indexing tax brackets for inflation didn’t happen by accident. It was a central element of the Reagan 1981 tax cuts. Prior to indexing, inflation kept relentlessly pushing Americans into ever higher tax brackets.

The Reagan Treasury Dept. Aide who fought valiantly for this reform – which Democrats were against – was our friend Steve Entin. How ironic that 40 years later that reform is saving average Americans thousands of dollars on their income taxes this year.

Thanks to the Gipper – and Steve Entin.