Here’s another reason we don’t want 80,000 new IRS agents.

The IRS has announced it will use artificial intelligence to audit business partnerships – including law firms, accounting firms, investment outfits, and other politically attractive white-collar targets for tax shakedowns.

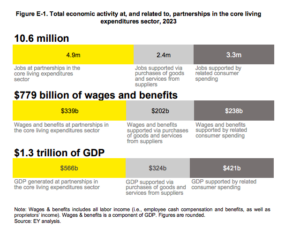

But a new study by the Small Business & Entrepreneurship Council finds that partnerships arent sinister tax havens, but legal entities that are essential to providing housing, transportation, food, health, child and elder care, clothing, financial services, and education. They also account for over 10 million jobs and $1.3 trillion of GDP:

Why is the federal government harassing small businesses to collect more money, rather than looking under its own hood and chasing down the fraudsters and syndicates who have stolen some $250 billion from taxpayers through rip-off schemes? They are the real criminals that are depleting the government’s coffers.