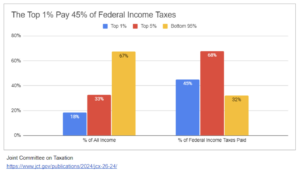

In the fiscal year just ended, the national debt surged by another $2.3 trillion. The ONLY plan the Dems have to fix this is to make the rich “pay their fair share.”

We asked Preston Brashers, the Heritage Foundation’s brilliant fiscal policy analyst, whether taxing every millionaire and billionaire at a rate of 100% would eliminate the budget deficit and stabilize the national debt.

Here was his answer based on the official data:

You can safely say that even if you taxed every penny of income earned by millionaires, it wouldn’t be enough to close the deficit. According to the Joint Committee on Taxation, millionaires had an estimated $3.312 trillion in income in 2024 and were expected to pay a combined $1.006 trillion in federal taxes. On the surface that leaves $2.3 trillion more that could be taken from them, which also happens to be the amount that the national debt increased during FY 2024.

However, that doesn’t account for the state and local taxes the rich pay (which would be substantial) or the Laffer Curve effect [that no one would work if the tax rate were 100%].

In other words, a tax rate of 100% won’t eliminate the budget deficit, but you can bet it will eliminate all the millionaires.