So now we have an IRS that will be twice as big, twice as intrusive, and twice as abusive. Congrats to Joe Biden.

Incredibly infuriating is the oft-repeated haughty claim by Maryland’s Dem Senator Ben Cardin: “If you’re not cheating on your taxes, you have nothing to worry about.”

Sure.

The 87,000 new agents are expected to conduct more than one million new audits. Anyone who has ever undergone the root canal surgery of an IRS investigation knows that the cost of defending yourself or your business can range from tens of thousands to millions of dollars.

Senators: you pay these costs to defend yourself even if you’re an honest taxpayer.

None of the Dems seem to care a wit about what this new IRS arsenal will cost private citizens and businesses. (It’s all about plucking more feathers from the geese.)

So here are some of the costs on the private sector as assembled by our friend Chris Edwards at Cato:

-

-

- The Office of Management and Budget estimates that individuals and businesses currently spend 6.5 billion hours a year on federal tax paperwork.

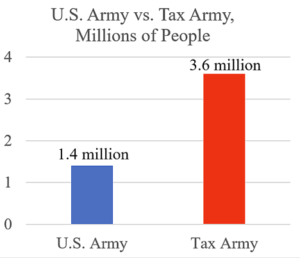

- This is the equivalent to 3.6 million people working full‐time on this unproductive activity. The late economist Walter Williams once famously calculated this is more man hours than to build every car, van, truck, and plane built in America.

- This is also two and half times larger than our uniformed military of 1.4 million service members, as shown in the chart.

- In order to combat Biden’s expanded IRS Army, private citizens and businesses will be forced to hire the equivalent of 140,000 more tax lawyers, accountants, bookkeepers, psychiatrists, etc. to combat the auditors.

- A simple flat tax would reduce compliance costs by as much as 90%, but of course, this bill ADDS scores of NEW complexities to the tax code.

-

Does ANY of this make any sense?