We laughed out loud at the media pronouncements that the Fed took a “hawkish” stand yesterday against the 8.5% consumer price rises and the 10% rise in producer prices that are wrecking the economy.

As we’ve said on these pages for a year now, the Fed is way late to this dance and its response of a half point rise in interest rates – up from near the near zero rates it set in stone for so long – is feeble at best. Fed chief Jerome Powell promised future rate increases, but here we must quote Lady Macbeth: “If it be done, best that it be done quickly.”

Commodity prices ROSE yesterday after the fed announcement in response to the rate hikes – meaning a market expectation of continued high inflation is still prevalent.

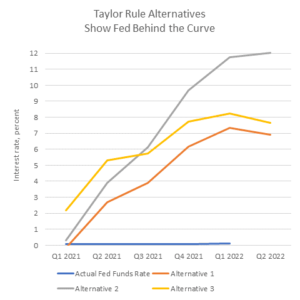

One rule of thumb on setting interest rates is the “Taylor Rule” – named after John Taylor at Stanford. We don’t think the Taylor Rule is iron clad and suitable for all occasions, but below we show three versions of the Taylor Rule and all of them indicate the Fed interest rates are way below where they need to be to get inflation back down to the two percent range.

Bottom line: the Fed isn’t taking the threat of persistent high inflation seriously. Perhaps they are too preoccupied with fighting climate change.