Just as we’ve been forecasting for months, the official inflation rate (CPI) fell to 3.0 percent in June – the lowest rate in two and a half years. That’s good news – especially when considering that this time last year inflation had soared to above 9%. Prices are roughly 16% higher today than when Biden entered office and that is a steep tax on Americans’ earnings and savings.

Polls over the past year consistently show that Americans don’t believe that inflation has fallen as much as is reported.

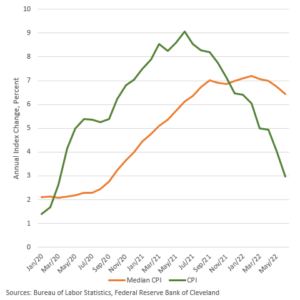

Why the big discrepancy between public perception about what is happening with prices and the government’s “official” numbers? One answer may be found in the Federal Reserve Bank of Cleveland statistic called median CPI, which “omits outliers” with wild price shifts. The chart below shows the difference between the two inflation numbers.

The orange line shows that the median CPI is now running roughly twice as high as the monthly CPI numbers. The things people have to pay for every day or week like gas, food, rent, and electricity are emphasized in the Cleveland Fed report. That may explain why consumers are still so angry these days about out-of-control price hikes.