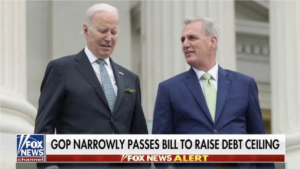

Joe Biden and House Speaker Kevin McCarthy will meet this week to “not negotiate” on the debt ceiling – which Biden’s own Treasury Department warns will require action by June 1 before the government loses its legal right to borrow more money. Biden is sticking with his hissy-fit position that he won’t make any deal to bring down government spending as any part of a debt ceiling extension.

But what if Biden temporarily put aside his far leftwing agenda, came to his senses, and did agree to the McCarthy plan that raises the debt ceiling in exchange for spending caps and other reforms that would reduce the debt by some $4.5 trillion over the next decade, reinstate work requirements for welfare programs, cap spending at one percent and increases American domestic oil and gas production.

A new stock market analysis by Jeff Yass of Susqunana Capital and David McIntosh of Club for Growth estimates $2.7 trillion in wealth in the marketplace. All the president has to do is put partisanship aside and say OK to very good legislation.

That $2.7 trillion includes avoiding a hit of about $900 billion in temporary losses from a debt ceiling breach and a huge boom from the bill’s pro-growth reforms.

This seems to us an economic and political no-brainer for Biden, so he probably won’t go for it.