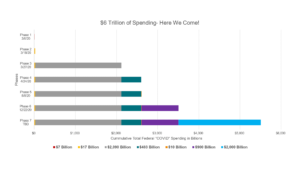

Regular readers of the Hotline know that we added upwards of $6 trillion in spending and debt during Covid and its aftermath.

But the OTHER stimulus was provided by the Federal Reserve Board when it purchased a mind-blowing $5 trillion in assets and put them on the Fed’s balance sheet. When the Fed purchases assets, it injects money into the economy, which certainly contributed to the Bidenflation which hit 9.1% in 2022 at the height of the asset purchases.

Most of this was the Fed purchasing federal treasuries (with most of the rest consisting of $2 trillion in mortgage-backed securities). In other words, Congress spent the money, the Treasury borrowed the money, and the Fed effectively printed the money and used those dollars to buy the government’s own debt. This is called monetizing debt and it’s a dangerous practice that rewards government profligacy – just look at Argentina and Venezuela.

The good news is the Fed has reduced its balance sheet from $9 trillion in late 2022 to just under $8 trillion today. It should speed up these asset sales and return as quickly to normalcy. If it doesn’t, this government Ponzi scheme will end about as well as it did for Bernie Madoff.