It turns out the Trump tax cut was a towering policy home run, not just flying over the fences, but out of the ballpark into the parking lot. The economic incentive effects were larger than even WE or the Trump Administration anticipated. That’s the conclusion of a new National Bureau of Economics Research study.

There’s a good summary of the technical study by our friend Bruce Thompson published in Real Clear Markets.

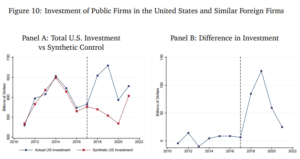

The study examined 12,000 corporate tax returns… The authors found that the corporate tax changes increased domestic investment by 20% in the two years after the bill was enacted, with most of the boost in capital investment coming from the lower corporate tax rate and bonus depreciation…

The study estimates that the corporate tax changes will increase the U.S. domestic corporate capital stock by 7.4% over the long run. The increased capital stock leads to increased worker productivity, resulting in increased real wages over the long run.

Even with this ironclad evidence of benefits far exceeding costs, the Democrats STILL want to raise the corporate tax rate and the capital gains and dividend rates. Apparently, when it comes to tax policy, they have no interest in following the science.