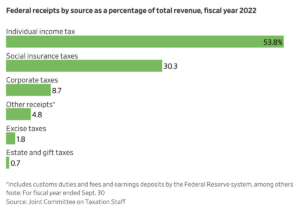

In 2022 (the most recent year we have complete IRS data), the federal government collected a grand total of 0.7% of its entire tax revenue stream from the estate/inheritance tax.

This greed and envy tax is completely irrelevant to the revenue-raising function of our tax system.

But the damage the death tax does to our economy is multiple times higher than the crumbs of revenues the tax raises. It reduces incentives to save, it reduces reinvestment in family-owned businesses, it cuts employment, and it siphons off tens of billions of dollars that could be put to productive use into economically worthless tax shelters. The Joint Economic Committee has estimated a $1 trillion long-term cost to our economy from this evil tax on money that has ALREADY been taxed.

America’s billionaires (who are supposed to be the target of the tax) wind up paying almost none of this tax. Why and how? They have the wherewithal to create multibillion-dollar tax foundations that shelter their wealth from the taxman. They hire the best attorneys, the best bookkeepers, and the best accountants to find clever ways around paying the tax. Zuckerberg, Gates, Bezos, Buffett, and Bloomberg won’t be paying much of this tax.

Biden’s “solution” is to cut the income-exempt amounts (roughly $12 million for an estate) in half to get more money out of smaller estates. This allows the IRS to carve into the legacy of family-owned businesses in America – which are the lifeblood of our economy.

There is no tax in American history that has collected so little revenue at such a giant cost to our economy. We would ALL be much richer if we abolished this tax.