| Unleash Prosperity Hotline Issue #388 10/13/2021 |

| 1) Pelosi Can’t Add We’ve argued on these pages for many weeks that the Stalinist policies that fill the 2,500 pages of the Biden, Pelosi, and Schumer Govzilla bill, are much more dangerous than its gargantuan price tag. Now we learn that Speaker Pelosi and her pals in the Progressive Caucus are in full agreement with us. They’ve decided to use a scheme of counting only five years of the bill’s cost, not the normal 10-year score. This shrinks the price tag of the bill from $3.5 trillion to $2 trillion in order to placate Democrat Senators Sinema and Manchin. It’s blatant phony-baloney bookkeeping, and even Pelosi admitted it yesterday: “We will not diminish the transformative nature of [the bill]…” They will reduce the reported cost of the bill “mostly by cutting back on the years” the spending is authorized. This is like a university president telling parents that the tuition for a degree is only $75,000 – but that’s only the cost for the freshman and sophomore years. This reminds us of the old joke about the accountant who is applying for a job and is asked in the interview with the CEO: “What is 2 plus 2?” And the accountant slyly answers: “What do you want it to be?” We can only hope that Sens Manchin and Sinema fully reject this cynical budgeting ploy. https://www.bloomberg.com/news/articles/2021-10-03/progressives-offer-to-cut-spending-short-to-salvage-biden-agenda https://www.speaker.gov/newsroom/101221-1 |

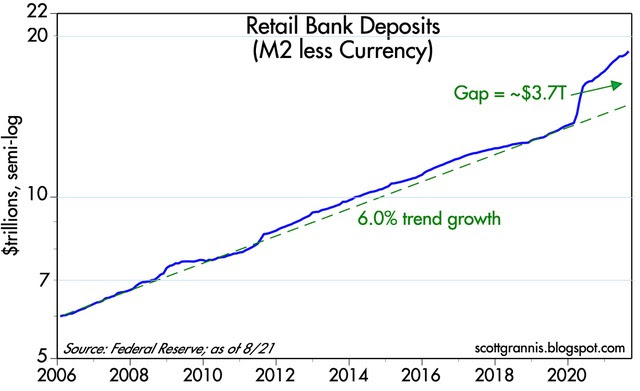

| 2) Still Drinking The No Inflation Kool Aid? The whimpers from the White House and the Federal Reserve Board that inflation is “transitory” becomes less persuasive with each passing day. This morning’s new CPI numbers show 5.4% year over year inflation and the September number on an annualized basis is above 6%. Recall from last week that the commodities index is at a five year high and is up than 50% over a year ago. Here are three additional charts from our friend and financial wizard Scott Grannis that we thought were eye-popping. You can make up your own mind if you think inflation is a problem. The commentary beneath each chart is from Grannis:  “M2 trend growth has been 6-7% for decades. Since Mar. 2020, M2 growth has blown away all past records for growth. Huge deficit financed spending has been the main source of household’s extra cash. M2 has been rising at a 13% annualized pace so far this year, on top of the huge increase in March-May of 2020.  “My thesis: money demand peaked more than a year ago. That could reverse now that inflation expectations are starting to rise. Attempts by the public to reduce money balances could drive lots of inflation. The fed has done nothing to offset this and probably won’t for a long time.”  “There is an 18 month lag between rising house prices and rising owner’s equivalent rent. We are only now at the beginning of the increase in OER. This could drive higher CPI inflation for the next year or two.” |

Subscribe to receive our full hotline