| Unleash Prosperity Hotline Issue #268 04/21/2021 |

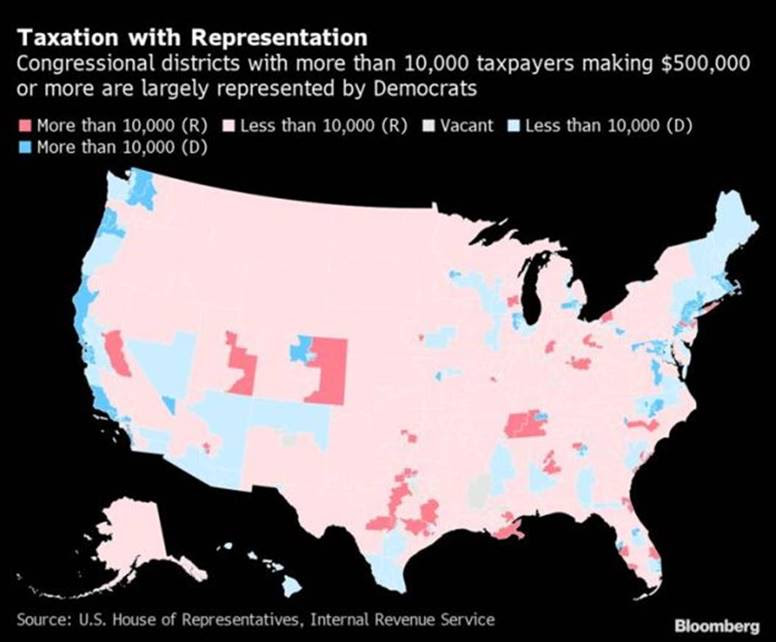

| 1) Two of Three Richest Americans Live in Democratic Districts The Democrats have promised to only tax Americans with incomes above $400,000, but new research shows almost two-thirds of those tax filers live in Democratic districts (as reported by Bloomberg). Will they sock it to their own voters? What’s the matter with New Jersey? This income-class profile of voters has completely flipped since the early 1990s. As we have noted before, Republicans used to carry about 80% of the wealthiest districts in the U.S. Now Democrats do. In fact, if we look at the wealthiest 10 percent of wealthiest districts, especially the affluent suburbs, such as the North Shore of Chicago, Democrats represent 38 of those seats now and Republicans have six. This is virtually a total reversal from 1993 when Dems represented just 10 of the wealthiest districts.  Dems are now conclusively the party of the very rich and very poor. Republicans are now the party of the middle class. The chart below shows the wealthiest counties and which ones are blue and which are red. We just wish Pelosi and Biden would stop pretending how their agenda “represents working-class Americans.”  |

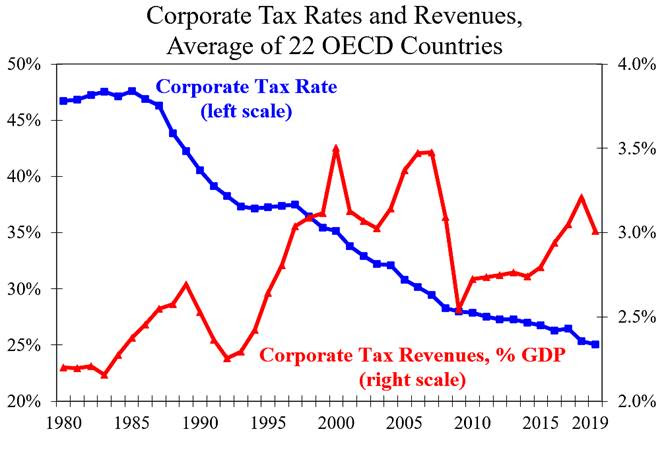

| 2) The Laffer Curve Strikes Again We noted last week that Treasury Secretary Janet Yellen’s complaint that the trend toward lower global tax rates has the story completely upside down. This isn’t a “race to the bottom,” it is a race for lower taxes globally (and freedom from oppressive government), and it is a race that, thanks to Trump’s tax cuts, America is WINNING. Yellen wants an international tax cartel to pump up marginal rates to end global tax competition – truly one of the worst ideas of all time. Now a new study comes along from Chris Edwards of the Cato Institute which finds that even though international tax RATES have fallen, it is a myth that corporate tax payments are lower.  Edwards finds that the average OECD corporate tax rate in the 1980s of 46.2% raised 2.4% of GDP. The average tax rate in the 2010s of 26.7% raised 2.9% of GDP. Lower rates, more revenue! It’s called the Laffer Curve. |

Subscribe to receive our full hotline