Read last night’s New York Post article by our own Stephen Moore:

Mirror, mirror on the wall, who’s the biggest presidential spender of them all?

Joe Biden wins that award by a landslide. That’s the depressing result from our new study at the Committee to Unleash Prosperity, based on the latest official money and budget forecasts from the Congressional Budget Office.

This may be a surprising conclusion given that Biden keeps touting his line that “we’ve cut the deficit drastically.” He even claims that last year he slashed the deficit by more than $1.4 trillion while boasting that this is “the largest debt reduction in American history.”

Every president has been prone to a bit of exaggeration on their record in office, but this one isn’t even within the galaxy of the truth.

Our new analysis of the latest CBO forecast covering the next 10 years reveals the most rapid deterioration of the federal balance sheet ever.

We compared the 10-year fiscal outlook the month Donald Trump left office with the latest forecast just two years later. This comparison indicates some $6.5 trillion of red ink ADDED by Biden to the Trump baseline he inherited. In other words, instead of Biden engineering “the largest debt reduction in history,” Biden has accomplished the polar opposite result: the largest debt INCREASE in American history.”

Here are the numbers:

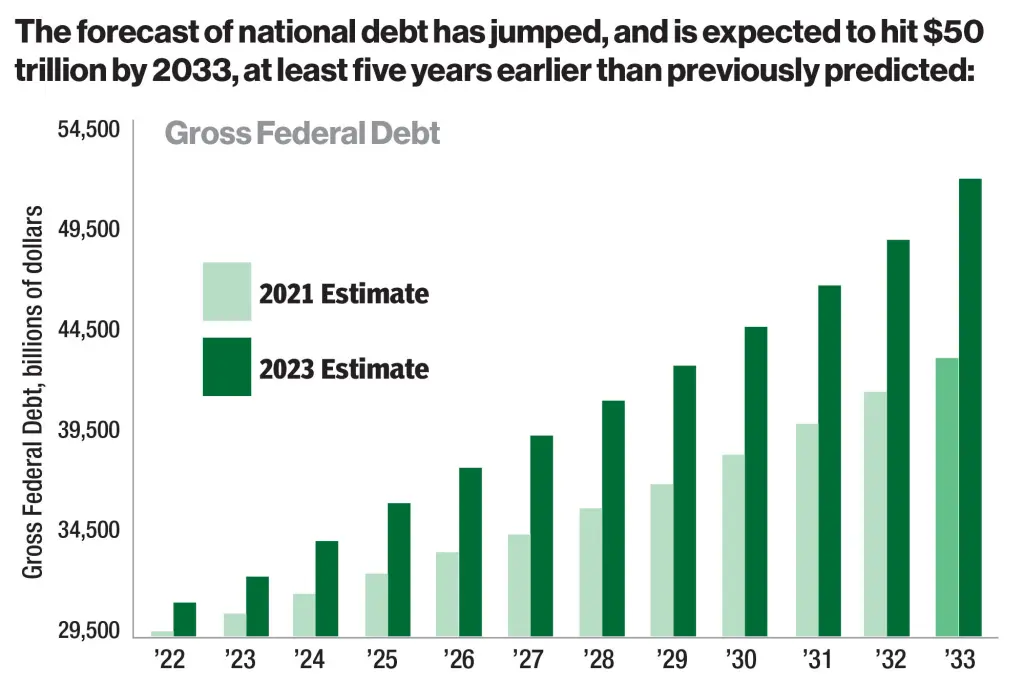

- In February 2021, publicly held debt was $35.3 trillion, with gross debt — which includes borrowed money that must be repaid to the Social Security and Medicare trust funds — hitting $40 trillion.

- Two years later, in February 2023, those figures were $40.9 trillion and $46.7 trillion respectively.

- That means President Biden added $5.6 trillion to the publicly held debt, and $6.7 trillion to the gross debt.

- The national debt is now scheduled to hit $50 trillion just 10 years from now — that’s roughly five years ahead of earlier forecasts.

This ocean of red ink is particularly inexcusable given that the COVID pandemic was essentially ending when Biden entered office. The debt shouldn’t be rising with the crisis long over; it should be shrinking fast. We should be running surpluses.

Think about it this way: If Biden had been president in 1946 and he applied the same economic tactics that he is using now, he would have run up the deficit to record levels AFTER World War II came to an end.

How is it that Biden has allowed debt spending to explode into the stratosphere so rapidly in such a short period of time?

There are four explanations:

- First, Biden and the progressives seized on the “crisis” (that was coming to an end) as an excuse to pass four major spending bills in two years — which added at least $4 trillion to the debt right out of the gate. To borrow a phrase from former Barack Obama chief of staff: they didn’t let the crisis go to waste. They used COVID as camouflage to disguise it to prop up a progressive social welfare spending budget blowout on programs like the Green New Deal and a bailout of blue state budgets.

- Second, Bidenflation caused the cost of government purchases to rise for everything from federal construction projects to food for the troops — just like the cost of everything else in the economy is surging.

- Third, interest expenditures on the debt have been exploding because the government was borrowing at record levels.

- Fourth, as inflation sprinted to above 9% last summer, the rise of “Bidenflation” forced the Federal Reserve to raise interest rates eight times. Rates are almost three percentage points higher, which has increased Uncle Sam’s borrowing costs by trillions of dollars.

We now find ourselves in the throes of a financial vicious cycle. The more Biden spends and borrows, the more inflation goes up, which in turn causes interest rates to rise, which requires more and more spending that is simply financing the cost of the $32 trillion debt.

If all of this isn’t bad enough, in five years the interest payments on the debt will reach $1 trillion a year and that will be more than we spend each year on our national defense.

In short, Biden’s multitrillion-dollar shopping spree isn’t just an economic and financial crisis, it is putting our national security in danger as well. Pretending it isn’t happening with happy talk about cutting the deficit is only insulting and witless.

Republicans aren’t blameless in this Washington spending splurge. But they can’t back down in budget negotiations. They can’t capitulate to the Biden demand that Congress raise the federal government’s credit-card limit without any plan to slow down the spending and borrowing juggernaut.

The latest CBO report shows clearly that to save our country, somebody has to stop Biden before he spends again.

Stephen Moore is a senior fellow at the Heritage Foundation and a co-founder of the Committee to Unleash Prosperity. His latest book is “Govzilla: How the Relentless Growth of Government Is Devouring Our Economy.”

You can find the article on the New York Post here.