| Illinois Senator Dick Durbin is making a mad last-minute push for price control regulations on Visa and Mastercard. (American Express is exempt.) The play here is to mandate that these two companies put cut-rate competitor logos on their cards and allow merchants to route their transactions over those other networks.

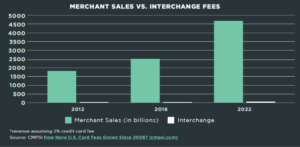

But Durbin, other Senate Democrats — and even our friend Roger Marshall a Republican from Kansas (who should know better) — can’t explain how this industry is broken. Americans love the convenience of using plastic cards for swiping and tapping to make purchases. They love the rewards programs. That’s why there are more credit and debit cards than there are people in America. That’s why Americans make trillions of dollars of purchases a year on plastic cards. Retailers love accepting credit cards because they almost all gladly take credit cards as forms of payment. Cards also reduce the burden of handling cash and theft at the cash register (by employees and thieves) while Visa and Mastercard assume the risk of non-payment. And they do all that for a remarkably small fee of roughly 2%. The chart below shows how small these fees are: Our advice to Dick Durbin: if it ain’t broken don’t fix it. And, by the way, when have government price controls EVER worked? |