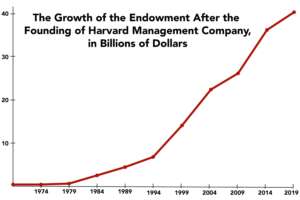

Speaking of Harvard, this is looking more and more like a money management firm, not an educational institution.

Why does it get special tax treatment? There is no tax on the money going in and no tax on the money flowing out. The university endowments are one of the biggest leakages in the tax system with hundreds of billions of dollars never taxed. The money ISN’T used to reduce college costs. Harvard charges more than $70,000 a year in tuition. By some estimates, it could charge the students nothing and pay for their education through the endowment, now until forever, and still not run out of money. Instead, the money goes to edifices and fat salaries.

Here’s our proposal: take away the tax exemption for money invested in universities and use the revenues to cut the capital gains tax on real investment to 15%.