| Unleash Prosperity Hotline Issue #243 03/16/2021 |

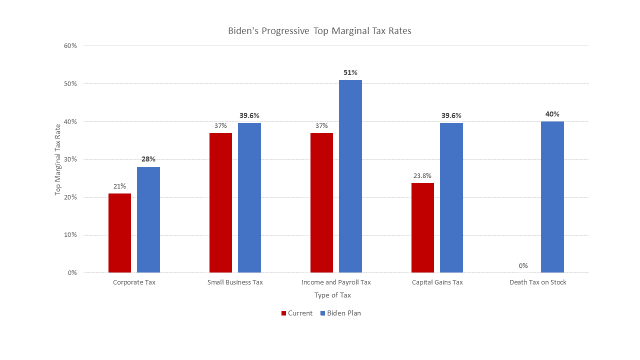

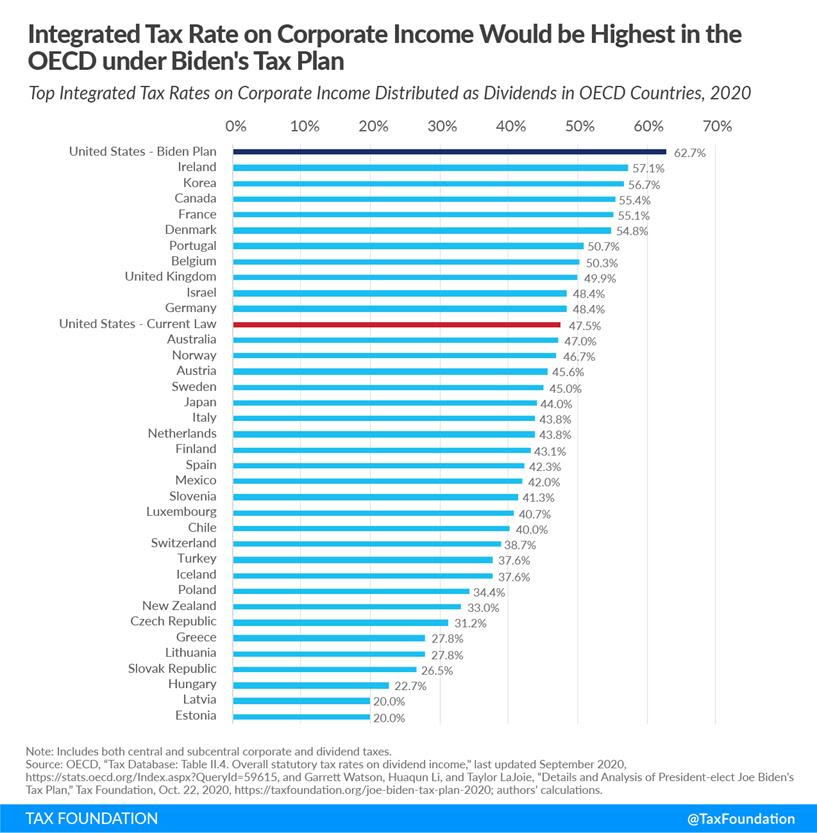

| 1) And Now For Biden’s $2 Trillion Tax Bill Biden and congressional Democrats have been meeting this week to figure out how to pay for their multi-trillion-dollar avalanche of federal spending. Another $2 to $3 trillion may be in the works for the green new deal and infrastructure projects. The Biden campaign tax plan calls for higher tax rates on small businesses, American corporations, capital gains income, dividends, and inheritances. The graph below shows that tax rates are headed to 50% or more.  From an international competitiveness issue, this gives all of America’s competitors a huge tax advantage. The Tax Foundation shows that the combination of the higher dividend tax and the rise in the corporate tax would give the U.S. the highest tax on corporate earnings in the world.  Treasury Secretary Janet Yellen is also exploring a carbon/energy tax and a 2% annual wealth tax. The wealth tax severely penalizes savings and asset accumulation – which are fertilizers for growth. A 2% annual wealth tax erodes about 25% of one’s assets over a decade and well more than half after 20 years. Why save? Why invest? Why work? |

Subscribe to receive our full hotline