| Unleash Prosperity Hotline Issue #247 03/22/2021 |

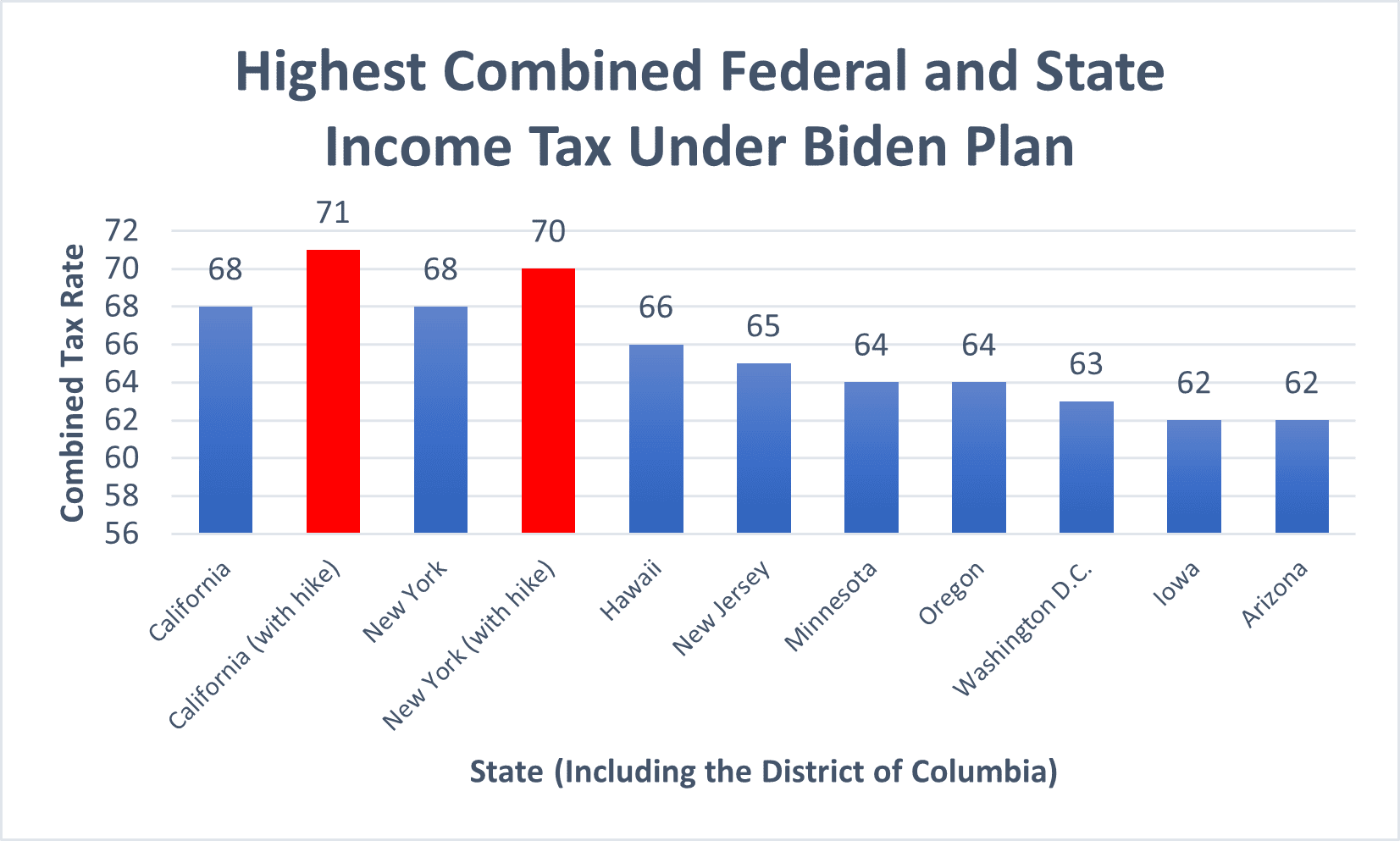

| 1) Get Ready for 70% Tax Rates A year ago the ideas of senators Bernie Sanders and Elizabeth Warren were so outlandish and destructive to growth that they seemed an impossible leftist dream. Now, we’re not so sure, as “soak the rich” is now the national anthem of almost all Democrats. The Biden tax plan that Congress will start debating this week or next would raise the top income tax rate to 39.6% from 37% today. But he also would impose a new payroll tax of 15% on earnings over $400,000, which could be as little as $200,000 each for a married couple. The combined payroll/income tax rate would bring the marginal tax rate on an additional hour of work to roughly 54%. But then you have to add the state income tax rates. Those are no longer deductible from federal taxes for high-income tax filers. Hence, if you live in a high-tax state, like New York, New Jersey, or California your marginal tax rate will start to approach 70%.  But it is worse than that. There is a proposal to raise the income tax in California, New Jersey, and New York. In the California General Assembly, there is a bill to raise the income tax rate to 16.5%. In New York, Governor Andrew Cuomo has proposed a two percentage point tax hike, which would raise the income tax in New York City to 15.5%. If these taxes were enacted, both states would have combined federal-state marginal income taxes on wages and salaries of right at 70%. New York and California would become virtually the highest tax places in the world. Congratulations. Why would anyone with a business or wealth stay in California or New York? |

Subscribe to receive our full hotline