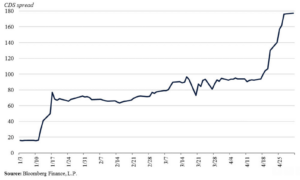

This is rich: All of a sudden the Biden Administration os spreading panic about higher interest rates costs due to debt ceiling gridlock. Biden’s Council of Economic Advisors has put out an analysis suggesting that interest rates paid for insurance on government bonds have risen by roughly 100 basis points (or 1%) because of investor worries about paying the bonds due to debt ceiling gridlock.

Cost of Insurance on Government Bonds

But compare that to what has happened to Fed action on interest rates in the wake of the Biden $6 trillion spending spree. The Fed funds rate has risen from close to zero to 5.25 percent. That steep rise in rates was triggered by the 9% inflation rate under Biden last Summer.

In other words, cutting government spending and bringing the trajectory of debt down could have a much bigger impact on lowering interest rate costs for Uncle Sam and private borrowers (for example, on mortgage rates) than the Biden plan of a deal with no cuts at all.