We’ve warned for many months of a burst in the housing bubble. We’ve repeated many of the mistakes of 2007-08 crazed housing market with continued subsidies from Fannie Mae, Freddie Mac, and the FHA. Low down payment loans of 3 and 4% are still near 100% guaranteed by Uncle Sam.

Now with Mortgage rates doubling from 3 to 6% and even 6.3% in some markets, housing values are going to fall to compensate buyers for the extra freight. Let’s hope this doesn’t mean a 2007-08 style crash landing.

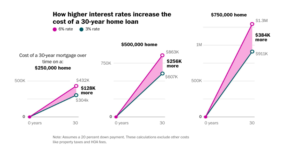

The Washington Post had an excellent explanation of the relationship between mortgage rates and mortgage costs.

For a $500,000 home, the higher interest rates on a standard 30-year mortgage add $256,000 to the cost of the home over the life of the loan. Of course, some of that extra cost is paying back the loan with inflation-adjusted dollars in the future that are worth less.

Alas, this has to drag down home values. Since Americans have much of their wealth tied up in the value of their home, this is another way that inflation kills savings and wealth.

Rates had to come up from their 20-year record lows, and the Fed tightening is just getting under way. We’ve said it before: Biden-flation is a killer of prosperity.