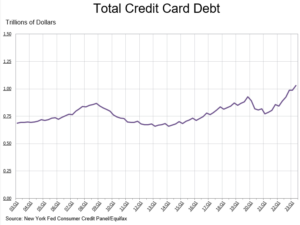

Here’s a dubious milestone from the latest New York Fed report:

Total household debt increased to $17.06 trillion, the latest Quarterly Report on Household Debt and Credit shows. Credit card balances saw brisk growth, rising to a series high of $1.03 trillion. Other balances, which include retail credit cards and other consumer loans, and auto loans increased to $0.53 trillion and $1.58 trillion, respectively. Student loan balances fell to $1.57 trillion, while mortgage balances were largely unchanged at $12.01 trillion.

Americans’ credit card debt is up roughly 30% in 30 months. That’s twice the inflation rate – which is what drove up this borrowing in the first place. When prices rise by 15% and incomes grow by 12%, then consumers can only pay bills by going further into debt. Gee, Bidenomics really is a success story, Joe.