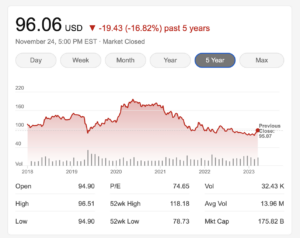

Disney has become a movie poster board of how ESG can wreck a company’s stock. In the last five years of a generally bullish market, Disney shares have far underperformed, with its stock value down 16%. That’s a dismal performance given that the Dow Jones is up 38% over that period.

Disney’s Dismal Stock Returns

There are many reasons for the downfall, but certainly one of them has been Disney’s abandonment of its wildly profitable brand image of providing wholesome, family-friendly, and politics-free content and entertainment.

Now in its latest SEC 10-K filing, Disney admits that its ESG activism is hurting the company’s bottom line.

Under a section entitled “Risk Assessment,” Disney officials admit:

Environmental, social and governance [ESG] matters and any related reporting obligations may impact our businesses…

Generally, our revenues and profitability are adversely impacted when our entertainment offerings and products, as well as our methods to make our offerings and products available to consumers, do not achieve sufficient consumer acceptance. Further, consumers’ perceptions of our position on matters of public interest, including our efforts to achieve certain of our environmental and social goals, often differ widely and present risks to our reputation and brands.

By some estimates, Disney’s four latest films with woke political content may lose almost $1 billion.

Will they ever learn?