The WSJ reviews Fed Chairman Bernanke’s press conference:

By our lights Mr. Bernanke’s least credible moment came on the dollar. The Chairman repeated the bromide that preserving the purchasing power of the greenback is a core central bank goal, which he said it will accomplish by keeping inflation low and reviving growth to attract capital from abroad.

Mr. Bernanke had clearly worked out his dollar remarks with Treasury Secretary Tim Geithner, whom he saluted for saying a day earlier that “our policy has been and will always be, as long at least as I’m in this job, that a strong dollar is in our interests as a country.”

The only trouble is that no one believes this. Capital has been fleeing dollar-denominated assets for months because investors believe that the Fed and Treasury are at best agnostic about dollar devaluation, at worst playing beggar-thy-neighbor to boost U.S. exports and force China to revalue its currency.

At Forbes, Seth Lipsky poses additional questions for Fed Chairman Bernanke.

The NY Sun laments Bernanke’s failure to mention gold.

On The Kudlow Report, David Goldman discusses Bernanke’s performance:

The OC Register cites Jude Wanniski on the 15:1 relationship between gold and oil prices.

On NRO, Larry Kudlow argues that stagflation is back.

In The WSJ, Dan Henninger scolds the President for his tax-the-rich rhetoric.

From The American Spectator, Peter Ferrara suggests the President doesn’t understand economics.

On Kudlow, Stephen Moore discusses the economy’s impact on the President’s re-election:

On Forbes, Louis Woodhill reports Greece is likely to default on its debt but can get back on track with pro-growth measures and sticking with the euro.

The Economist applauds China for its appreciating currency.

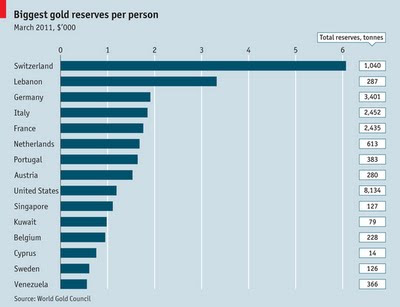

At Economic Policy Journal, Robert Wenzel notes per capita gold reserves (h/t: Free Banking):

Cato offers Lew Lehrman and Ron Paul’s book, The Case for Gold.